UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

(Name of Registrant as Specified In Itsin its Charter)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ No fee required. | ||||

☐ Fee paid previously with preliminary materials. | ||||

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

Notice of

Notice of each classAnnual Meeting of securities to which the transaction applies:

![[MISSING IMAGE: lg_kls-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-107811/lg_kls-pn.jpg)

Stockholders

November 2, 2022

To our stockholders:

YOUR VOTE IS IMPORTANT

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of KLA Corporation (“we”KLA,” “we,” “us,” “our” or the “Company”), a Delaware corporation, will be held virtually on Wednesday, November 4, 20202, 2022, at 12:00 p.m. PST,PDT, in the Plus Building of our Milpitas headquarters, located at One Technology Drive, Milpitas, California 95035, for the following purposes:

| 1. | To elect the ten candidates nominated by our Board of Directors (the “Board”) to serve as directors for one-year terms, each until his or her successor is duly elected and qualified. |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2023. |

| 3. | To approve on a non-binding, advisory basis our named executive officer compensation. |

| 4. | To consider a stockholder proposal requesting our Board to issue a report regarding net zero targets and climate transition planning, if properly presented at the meeting. |

| 5. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on September 16, 202012, 2022, are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

For admission to the Annual Meeting, stockholders should come to the stockholder check-in table. Those who hold shares of our common stock in their own names should provide identification and Chief Executive OfficerMilpitas, California

| Sincerely, | ||||||||||

|  Richard P. Wallace President and Chief Executive Officer Milpitas, California |

This Notice of Annual Meeting of Stockholders, Proxy Statement and form of proxy are being made available electronically and mailed on or about September 23, 2020.

All stockholders are cordially invited to attend the Annual Meeting |

IMPORTANT INFORMATION REGARDING MEETING ATTENDANCE

We are sensitive to the public health and travel concerns our stockholders may have regarding our in person Annual Meeting and recommendations that public health officials have issued and may issue in light of the continuing public health crisis caused by COVID-19. As a result, we will enforce appropriate protocols consistent with then applicable federal, state and local guidelines, mandates or recommendations or facility requirements. These requirements may include the use of face coverings, proof of vaccination and maintaining appropriate social distancing. We may also impose additional procedures or limitations on meeting attendees. We plan to announce any such updates on our website https://ir.kla.com/news-events, and we encourage you to check this website prior to the Annual Meeting if you plan to attend.

| 2022 Proxy Statement

| 2022 Proxy Statement

Table of Contents

Table of Contents22 | Standards of Business Conduct; Whistleblower Hotline and Website | ||||||||

| 22 | |||||||||

22 | Compensation and Talent Committee Interlocks and Insider Participation | ||||||||

| 22 | |||||||||

| 22 | |||||||||

| 22 | |||||||||

| 23 | |||||||||

| 28 | Proposal Two: Ratification of Appointment of PricewaterhouseCoopers LLP as | ||||||||

| 28 | |||||||||

| 28 | |||||||||

| 29 | |||||||||

| 29 | |||||||||

29 | |||||||||

30 | Proposal Three: Approval of | ||||||||

| 31 | |||||||||

35 | Security Ownership of Certain Beneficial Owners and Management | ||||||||

| 35 | |||||||||

| 36 | |||||||||

| 37 | |||||||||

38 | |||||||||

| 38 | |||||||||

| 38 | |||||||||

| 2022 Proxy Statement

| 2022 Proxy Statement

Corporate Governance Standards

Corporate Governance Standards

FOR

FOR

AGAINST

AGAINST Committees*

Committees*

Citrix Systems, Inc.

Citrix Systems, Inc.

Fiscal Year 2022

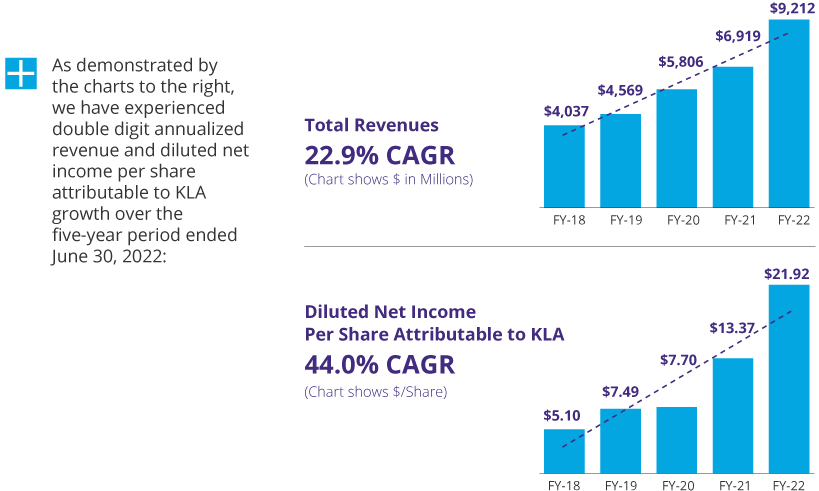

Fiscal Year 2022 33.1% since FY21

33.1% since FY21 Proposal One: Election of

Proposal One: Election of

Information About the

Information About the![[MISSING IMAGE: tm2030215d1-pc_diversity4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-107811/tm2030215d1-pc_diversity4c.jpg)

![[MISSING IMAGE: tm2030215d1-lc_price4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-107811/tm2030215d1-lc_price4c.jpg)

![[MISSING IMAGE: tm2030215d1-bc_revenue4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-107811/tm2030215d1-bc_revenue4c.jpg)

![[MISSING IMAGE: tm2030215d1-pc_ceo4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-107811/tm2030215d1-pc_ceo4c.jpg)

![[MISSING IMAGE: tm2030215d1-fc_formulabw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-107811/tm2030215d1-fc_formulabw.jpg)

![[MISSING IMAGE: lg_fsc-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-107811/lg_fsc-bwlr.jpg)

![[MISSING IMAGE: tm2030215d1-proxy1_klabw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-107811/tm2030215d1-proxy1_klabw.jpg)

![[MISSING IMAGE: tm2030215d1-proxy2_klabw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-107811/tm2030215d1-proxy2_klabw.jpg)

IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.